Personalized Guidance And Strategic Insights

Whether you’re an individual investor seeking to grow your portfolio or a corporate entity looking for strategic investment advice, our advisory services are designed to meet your specific needs. We take the time to understand your objectives, risk tolerance, and investment preferences to develop customized solutions that align with your goals.

Seize Opportunities With Confidence With Comercio Partners.

- Our approach

Trust In Our Proven Track Record Of Success

Equity Capital Market (ECM)

Our knowledge of the Nigerian equities market, especially the organized exchanges of The Nigerian Stock Exchange and the NASD OTC Plc, is built on years of practical experience working on various listings and capital raising assignments. Beyond the organized exchanges and depending on the needs of our clients, our equity capital market solutions are tailor-made for each client’s need. Our solutions range from raising private equity capital to listing on organized exchanges.

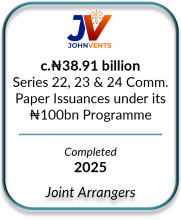

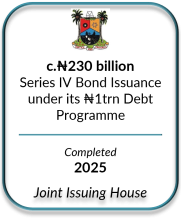

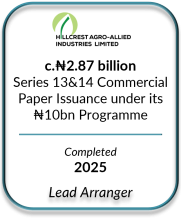

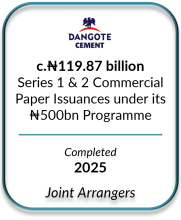

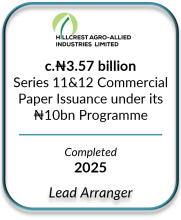

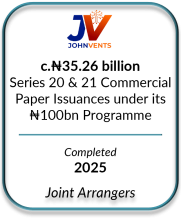

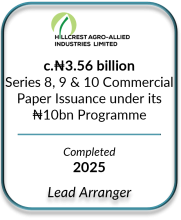

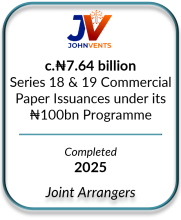

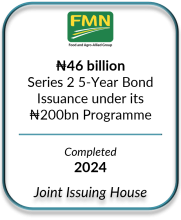

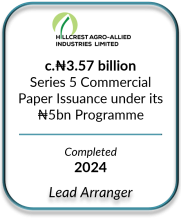

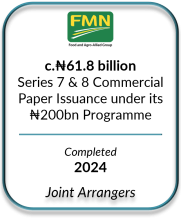

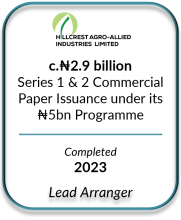

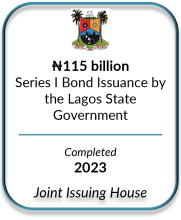

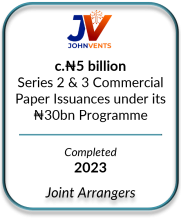

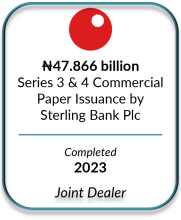

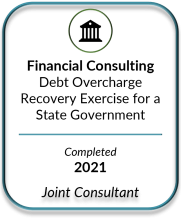

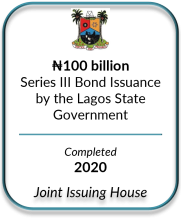

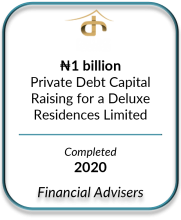

Debt Capital Market (DCM)

The core activities of the Trading and Investment Management arms of Comercio Partners Limited, which are performed in the debt capital market, underly our understanding of the dynamics of the market. We also leverage on the combined experience of our founding Partners which was garnered over 3 decades while working for various leading multinational banks. Building on our double-edge experience (Trading and Investment) in the space which continue to generate superior returns year-on-year, our advice to our DCM clients are informed by solutions which have been tested on various grounds, proven to be resilient and certain to deliver value to their businesses. Our DCM solutions are built on our knowledge and experience of the organized debt markets and the private debt capital space.

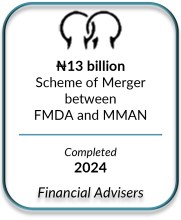

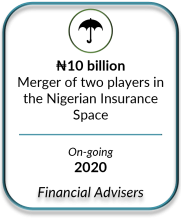

Merger & Acquisition (M&A)

Our M&A solutions to our clients are proposed based on clients’ request and after the review of their peculiar circumstances to ascertain that the solution is the best-fit to meet their needs. Also, depending on the range of solutions available and the quantitative and qualitative implications of each solution, we may recommend our M&A solution to our clients. We work hand-in-hand with the other entities in an M&A deal to ensure that equitable and fair bases are established for determining the values of the entities in the M&A deal. Determining value for our clients are built not only on their intrinsic value computed on a stand-alone basis, but also considering the synergies that will be realized over and above the simple one-to-one addition of the merging businesses.

Products

Our sales and trading professionals help investors find new opportunities in Sub-Sahara Africa debt market and US equities. We have a highly regarded Sub-Saharan Africa strategy and keen insight of US equities. Our array of products include: Government & Local Bonds, Eurobonds, Treasury Bills, Money Market, Derivatives, Equities (US and local).

- Client success in Risk Management and Compliance

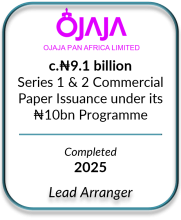

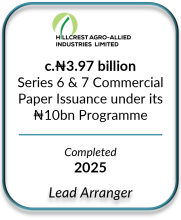

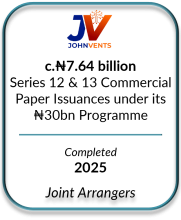

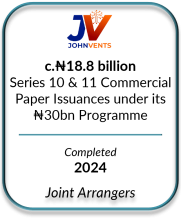

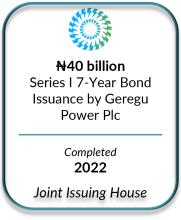

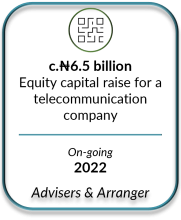

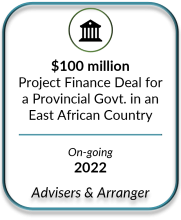

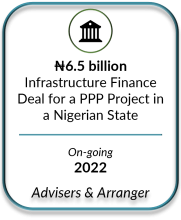

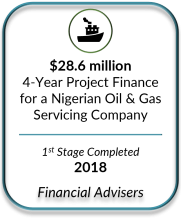

Milestones

Throughout our history, we’ve reached significant milestones that have shaped our growth and positioned us as a leader in the African financial services sector. From expanding our service offerings to reaching new markets, each milestone represents a step forward in our mission to empower individuals and businesses to achieve their financial goals.

Related Insights

Explore our success stories to see how we have helped businesses like yours overcome challenges and achieve tangible results.

Speak To A Wealth Advisor

Expected loss reduction

We assisted a leading merchant acquirer in the travel and airline industries with risk management and compliance, resulting in reduced exposure, lower expected losses, and increased profitability in high-risk sectors during a crisis. We successfully reduced the client’s exposure by over one-third and mitigated expected losses by approximately 85% during this turbulent period.

Uplift

A global USA bank partnered with us to enhance their treasury, asset and liability management operating models, as well as their liquidity and interest rate risk management process. Through this transformational engagement, we made revisions to the client’s behavioral models and hedging strategy

Automotive industry

We designed and implemented a global integrity and compliance program for a world-leading automobile manufacturer. The program focused on implementing processes and inspiring people, strengthening governance and processes across more than 500 legal entities worldwide. Through diverse communication, training, and enablement initiatives, we engaged all employees on the path to achieving sustainable culture change.